With a Flexi personal car loan, you get incredible adaptability and also cost as you don't invest excess amounts paying rates of interest accurate that has actually not been made use of. This brings down your EMIs as well as assists you manage your financial resources easily. Essentially, a flexi personal finance must be used when it comes to an emergency situation.

- Bank of China is one of the biggest banks on the planet and also is China's many globalised as well as integrated bank.

- The advantage will be that rate of interest will only be charged on the quantity taken out by the customer.

- Minimal documentation is needed for disbursal of the financing such as ID proof, address proof, earnings evidence, etc.

- Yet, sometimes there are different reasons that hinder us from selecting it.

- Just like others, you may be compelled to take credit rating to handle the unintended expenses.

Under Bajaj Finserv Flexi Lending product, you need to pay interest-only EMI of only Rs 12,500 monthly. Ultimately, you obtain one more Rs 8 lacs from the very same car loan account. MyLoanCare is an independent expert company as well as is not connected to the government or federal government bodies or any regulator or any type of credit score information bureau by any means.

Distinction Between Flexi Loan As Well As Term Lending

One can get instant approval with the money being attributed straight to the savings account in just 24-hour. Further, applying for such a lending online also just takes a couple of minutes. Term car loans normally have a rigorous approval procedure that calls for a lot of confirmation as well as documents.

Passion Can Be Lowered With Higher Down Payments In Flexi Current Account

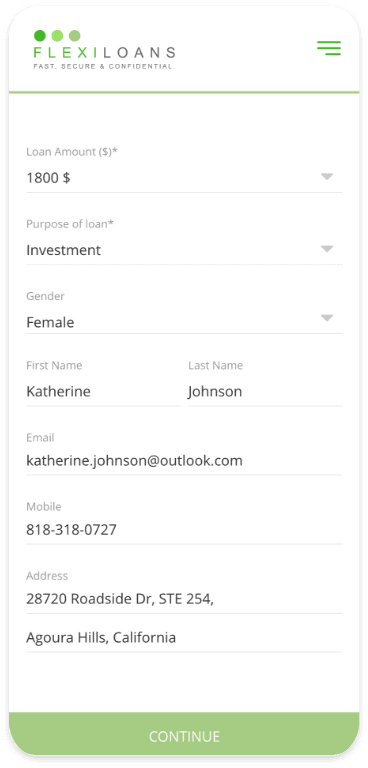

Customers can get info pertaining to the format for the exact same through the consumer care of FlexiLoans. Crossbreed Flexi Loans-- When it comes to a hybrid Flexi financing, only the preferred quantity gets paid out to the account. This allows complete accessibility to the funding and the payable amount. SMEStreet is quick growing platform devoted to entrepreneurs from small as well as moderate sized companies. Dedicated to assist in Understanding & Networking for Service Development, SMEStreet provides value added web content which shows the actual voice of Indian MSMEs.

There are several methods to access your account information and also make a request to BFL. You have maintained consistent funds over the ordinary monthly balance. The financing comes to be absolutely no at the end of the tenor as the Drawing Ability lowers on a monthly basis. After the approval, you will certainly get on the internet accessibility of Bajaj Finserv Website- Experia.

In a flexi lending, the bank, NBFC, or fintech sanctions a defined restriction. The customer can utilize any quantity from this accepted credit line several times according to their demand. The debtor is charged a regular monthly rate of interest for the quantity withdrawn/utilised. Flexi Loans let you pay money right into your mortgage whenever you desire, as well as withdraw that cash whenever you like. Making home loan overpayments and you'll have the ability to minimize your home loan principal, passion, as well as tenure. Full Flexi financings are often linked to a present or cost savings financial institution account to make it easier to manage your house financing, ideal for people with a variable revenue.

While both the options will certainly help you get the essential financing there are a couple of aspects that establish them apart. Personal financings and also Flexi lendings can cover a range of economic objectives like marriage, education, residence restoration, holiday, overhead, and so on. Nevertheless, the difference is quite noticeable in regards to their nature, interest rate, loan disbursal and the setting of repayment.

To make certain that customers cruise through the challenging situation efficiently, financial institutions use the Flexi-Personal Lending. Any kind of company requires money periodically to run its company. Sometimes it occurs that because of the businessman's money getting embeded the marketplace, there is not enough money readily available to the entrepreneur. Article effective verification of your information, the lending institution will certainly pay out the total flexi meaning in tamil up to your loan account. A flexi loan will provide you with a credit line where the sanctioned limitation will certainly be dealt with. Term lendings are normally organization finances meant for small businesses to meet their working capital requirements and other similar demands.